Why Men Wait: ADHD, Finances, and the Myth of Coping Alone

Money is emotional for everyone, but for many adults with ADHD it can feel like a constant source of guilt and anxiety. Some people come to me for ADHD financial coaching when things are just beginning to slip. Others wait until the situation has spiralled; debts mounting, savings gone, relationships under strain.

Over the years I have noticed a pattern. It is often women who seek help early, while men tend to wait until the financial pressure is unbearable.

At in-person workshops I have run about financial emotions, only women came. One woman said, “My husband should be here, but he won’t come.” That stayed with me. It was not about interest or ability. It was about what men are taught to believe about money and strength.

The Pressure to Cope Alone with Money

Many men grow up thinking they should be able to manage money by themselves. They see asking for help as failure. By the time they reach me, they have often been carrying hidden financial stress for months or years. Credit cards maxed out, unpaid tax returns, or a constant dread of checking the bank balance.

ADHD can make managing money even harder. Tasks like budgeting, opening letters, or tracking spending can feel overwhelming. Avoidance builds quietly until the financial situation becomes urgent. It is not carelessness or lack of intelligence, it is an ADHD brain struggling with executive function and emotional regulation.

Why This Isn’t Just a “Men’s Issue”

While this post focuses on men, many women and non-binary people experience the same pattern: the need to look in control, the fear of being judged, and the habit of coping alone. These pressures cut across gender. What changes is the story society tells us about what we should do when money becomes difficult.

For men, the message is often do not show weakness. For women, it can be keep everything running smoothly for everyone else. For non-binary or gender-diverse people, it can mean feeling unseen altogether. The result is the same: financial stress carried in silence.

The Hidden Cost of Financial Avoidance

The cost of waiting is rarely just about numbers. It shows up in burnout, relationship strain, and declining health. I have worked with men who stayed in jobs that drained them because they were terrified of losing income, and others who kept their debt secret until the shame became unbearable.

Money worries trigger the ADHD nervous system into overdrive. You might over-spend to escape the discomfort, then crash into guilt afterwards. Or you might freeze completely, unable to open bills or file taxes. Either way, the stress compounds.

When clients finally reach out and begin to understand how their ADHD affects money management, something remarkable happens. They start to see money not as a symbol of failure, but as a tool they can learn to use with clarity and confidence.

Learning to Work With Your ADHD Brain

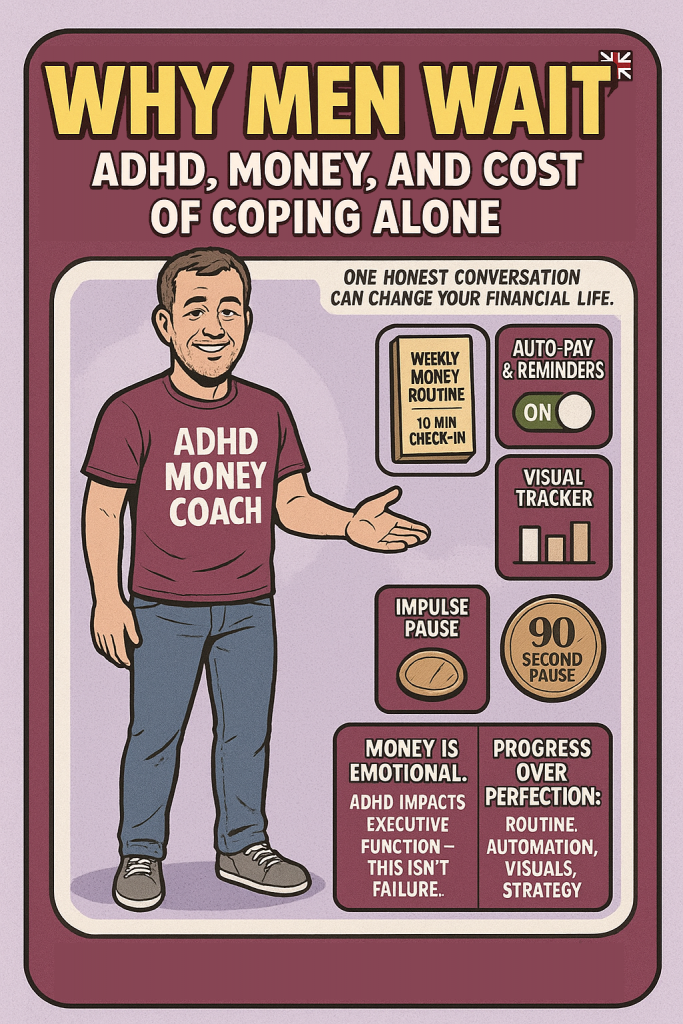

In coaching, we focus on small, practical systems that make managing money feel achievable again.

That might include:

- Building a weekly money routine that fits your energy levels

- Using automated payments and reminders to reduce pressure

- Setting up visual tracking tools that give instant feedback

- Developing strategies for impulse spending and emotional triggers

The aim is not perfection, but progress and self-trust. When financial decisions start to feel calmer, people often notice improvements in focus, mood, and relationships too.

Taking the First Step

If this feels familiar, you are not alone, and you do not have to face it alone. The first step is not about fixing everything overnight. It is about starting a conversation.

I offer a discovery call where we can talk about your financial challenges and how ADHD coaching can help you regain control. Click here to book a discovery call . Sometimes, one honest conversation can change the direction of your financial life.

Final Thought

Whether you identify as male, female, or non-binary, ADHD can distort your sense of control and confidence around money. You deserve to feel capable, organised, and secure in your finances. No one should have to carry that burden alone.

See here for ADHD Imposter Syndrome: 7 Ways to Turn Self-Doubt into Strength.